What is a CHESS-sponsored trade?

The term “CHESS-sponsored trades” has been bandied around by marketing teams of various brokers but what does this term actually mean? CHESS stands for Clearing House Electronic Subregister System. Basically, it’s a computer system operated by the ASX that facilitates the buying and selling of shares listed on the exchange by managing the settlement of share transactions and recording shareholdings.

In reality, there is no such thing as a ‘CHESS-sponsored trade’ as all trades in Australia, whether through ASX or Cboe (including those placed on Superhero), are cleared and settled via CHESS.

However, when people use the term “CHESS-sponsored,” they most likely mean that your shares are held by a market participant in your name on a Holder Identification Number, usually referred to as a ‘HIN’.

How do I trade AU Securities?

To trade AU shares, you will first need to transfer NZD into AUD in your Superhero Wallet. Once you have transferred NZD to AUD, you can trade AU shares by searching for or selecting investments on the ‘Invest’ tab within your account. Once you have found the share or ETF you wish to trade, you can Buy or Sell.

To transfer NZD to AUD in your Superhero wallet, click on the FX Transfer tab and follow the steps.

Steps to transfer:

1. Type in the dollar amount you want to transfer (NZ$100 minimum)

2. Click ‘Calculate’. This will hold the rate for 10 seconds

3. Once satisfied with the rate, click ‘Confirm’

4. Your funds will be transferred into AUD in real time and will appear in your AUD wallet.

How do I set a stop loss order with Superhero?

- Choose a holding from your portfolio and set ‘Order Type’ to ‘Stop Loss Order’.

- Set the trigger price. This is the price at or below which your shares or ETF units will begin to sell.

- Choose the number of units you would want to sell in case the price falls to or below the trigger.

- Tap ‘Review’ and check the details of your new Stop Loss Order.

- If you’re happy with it, submit it. You can always view or delete the order later from your dashboard under the ‘Pending’ tab.

Please note: Stop Loss orders are currently available for AU Trading only and valid for 180 days after you place the order.

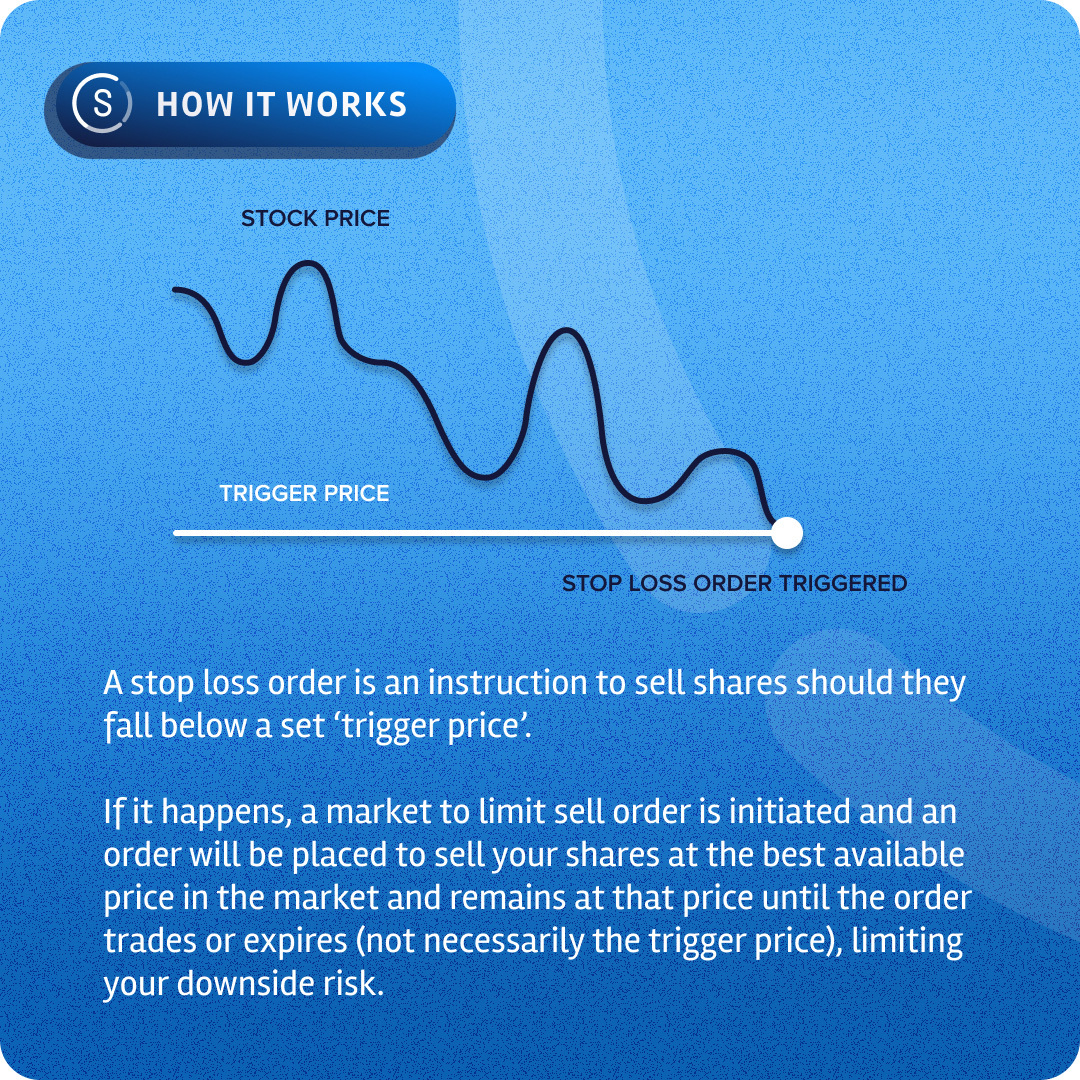

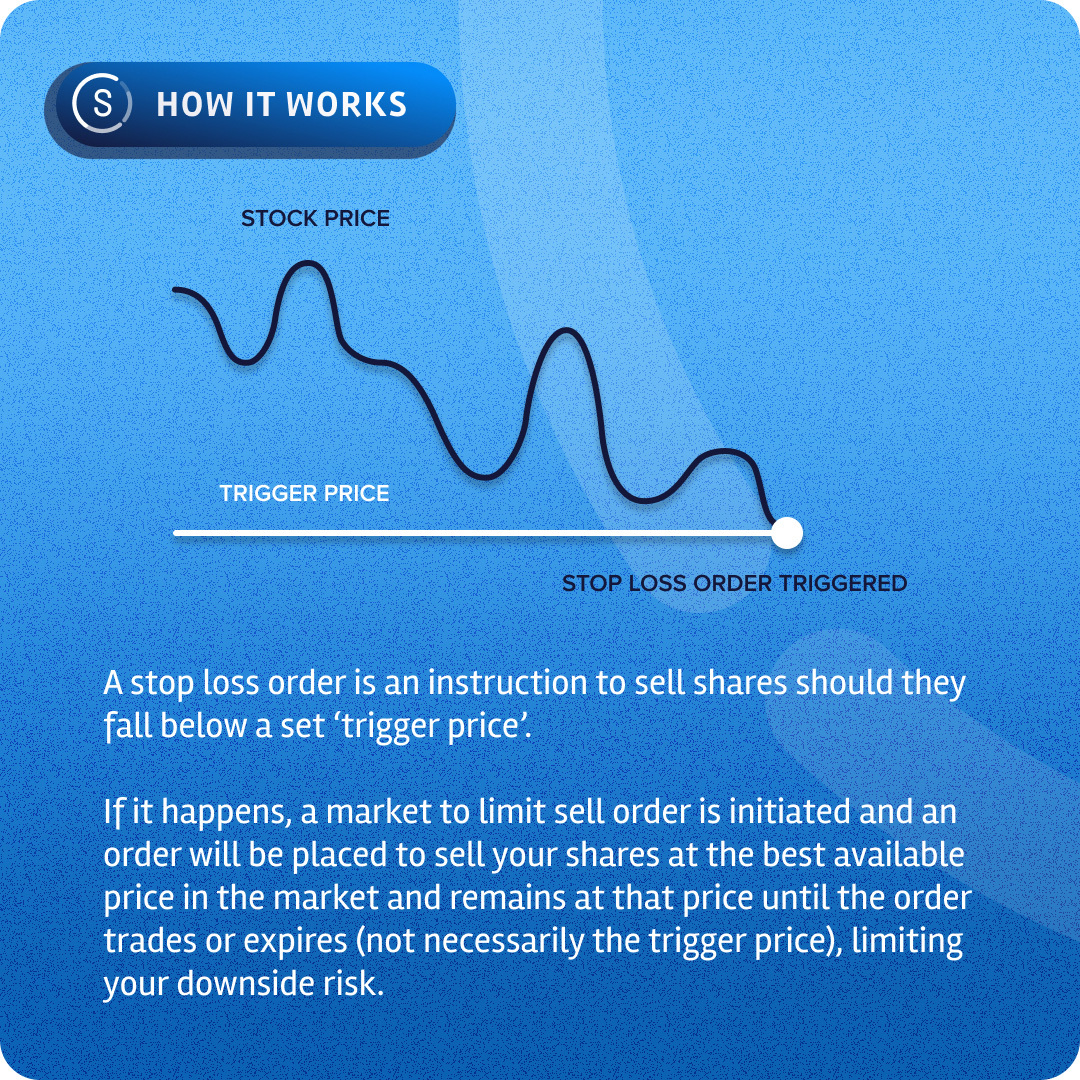

What is a stop loss order?

A stop loss order is an order to commence selling a stock once the share price reaches a specified price, known as the ‘stop’ or ‘trigger’ price.

When the ‘stop’ or ‘trigger’ price is reached, a stop loss order becomes a market to limit sell order. For market to limit sell orders, an order will be placed at the price set by the highest buyer in the market at the time the order is placed and remains at that price until the order trades, or expires.

Stop loss orders are most commonly used by investors to assist in limiting downside risk.

Note, that because the trigger order will be a market to limit sell order, the price you receive may not be the exact price you set the trigger price at.

Example: You purchase a stock at $10 per share and you set a stop loss order at $8 to protect yourself from further losses. The trigger price is reached and your stop loss order is sent into the market as a market to limit order to sell your shares at the best available price in the market and remains at that price until the order trades or expires.

Please note: Stop Loss orders are currently available for AU Trading only and valid for 180 days after you place the order.

What are recurring orders?

Recurring orders allow you to schedule automatic buy order(s) on a regular schedule.

You can set up a recurring order for any share or ETF (Australian or U.S.) on the Superhero platform:

- Log in to your Superhero account.

- Deposit funds into your Wallet (you can set up a recurring payment from your bank to your Superhero Wallet to automate this step).

- Find the share you want to invest in from the ‘Invest’ tab or the search bar and select ‘Buy’.

- Select the ‘Recurring Order’ option and set up your investment amount and schedule.

- Confirm your order.

You’ll be able to see your recurring orders in the ‘Pending Orders’ tab of your Dashboard.

Australian shares have a minimum of A$100 and cannot be bought as fractional shares and U.S. shares have a minimum of US$10 per trade. You will need to have these minimums available in your Wallet in the correct currency before you set up recurring orders.

You can also set up automatic deposits from your bank account to your Superhero account to ensure you always have funds to cover your recurring orders.

Why didn’t my recurring order trade?

The main reason your recurring order/s may fail is because you don’t have enough funds in your Superhero Wallet on the day your recurring order is due to execute.

If you do not have enough funds in your account, we will attempt to re-submit your order on each subsequent day, until the order is placed.

Keep in mind that for recurring orders of Australian shares the minimum order size is A$100 or one whole share, whichever is greater, as Australian shares cannot be bought in fractional units.

For recurring orders of U.S. shares the minimum order size is US$10 and you will need to have funds already converted into U.S. dollars.

Are there any fees to transfer my shares to another person/entity (an off-market transfer)?

Transferring your shares to another person or entity is called an off-market transfer. (This is not a broker to broker transfer). There are two different types of off-market transfers with Superhero.

An internal off-market transfer is when you transfer your existing shares to another Superhero account (incl. deceased estates, change of beneficial owner, etc).

An external off-market transfer is when you transfer your existing shares to another entity, external to your Superhero account.

There is a cost to conduct this type of transfer and we pass this cost on.

Please see the Superhero Fee Schedule for further information.

What is the ASX?

The ASX stands for The Australian Securities Exchange. The ASX is Australia’s largest securities exchange and one of the 10 largest exchanges in the world by market capitalisation.

According to the ASX website, ‘ASX acts as a market operator, clearing house and payments system facilitator. It oversees compliance with its operating rules, promotes standards of corporate governance among Australia’s listed companies and helps to educate retail investors.’

What is a Limit Order?

A Limit Order is an order to buy or sell a certain number of shares for a specified price (or better).

Limit Orders expire 30 days after you place the order.

How do I place a trade?

You need to add funds to your Superhero Wallet before you can trade, and transfer funds to the currency of the share you wish to purchase.

Once your Wallet is funded, you can search for a share or go to the ‘Invest’ tab to find and click on the share you wish to buy or sell.